Posted on December 9, 2014

Fort Myers Engagement Photographers

|

|

| Nothing short of AMAZING! posted 2014-12-15 |

| When I started looking for photographers to take our engagement photos Scott Kelsey Photography was one of the first ones I looked at and kept going back time and time again. After I contacted them, I received a super prompt and thorough response; I knew I found the photographers for us! They were extremely helpful in deciding where to shoot, what time, how many outfits, and many other details! They even made a shared Pinterest board of some types of poses I wanted to capture during our shoot. The day of was extremely cold and sooooooooooo windy (hard to believe in usually sunny Florida) and they were even willing to reschedule. We pushed through, and we still got soooooo many beautiful shots! Scott and his wife Linsey were so much fun to work with and it was neat to see both their creative eyes for getting the perfect photos for us! I would (and have) recommend them to everyone looking to have their photos taken in the SW Florida area! Did I mention, you get the shoot, unlimited photos with artistic enhancements, copyrights to the photos (where I’ve found a lot of photographers will not give you for engagement photos), and a beautiful personalized disc with all the photos from your session. If you book with Scott Kelsey Photography you will not be disappointed. Your hardest decision after reading this review will be choosing which photos to print after your amazing photo session with those two! Thanks Scott & Linsey Kelsey!!!… |

Posted on December 7, 2014

October brings magical sunsets to Sanibel Island, Florida. The sky was painted yellow, orange, and pink which reflected off the water, filling the scene with warm luminous light—Perfect for a beachfront ceremony. The ceremony was located at the old Florida Island Inn Resort on Sanilbel Island.

Sanibel Island Wedding Photographers | Scott Kelsey Photography

Posted on November 8, 2014

Posted on November 8, 2014

Fort Myers Beach Engagement

Please read this wonderful review that Sam sent us on instagram…

Posted on November 5, 2014

Posted on August 5, 2014

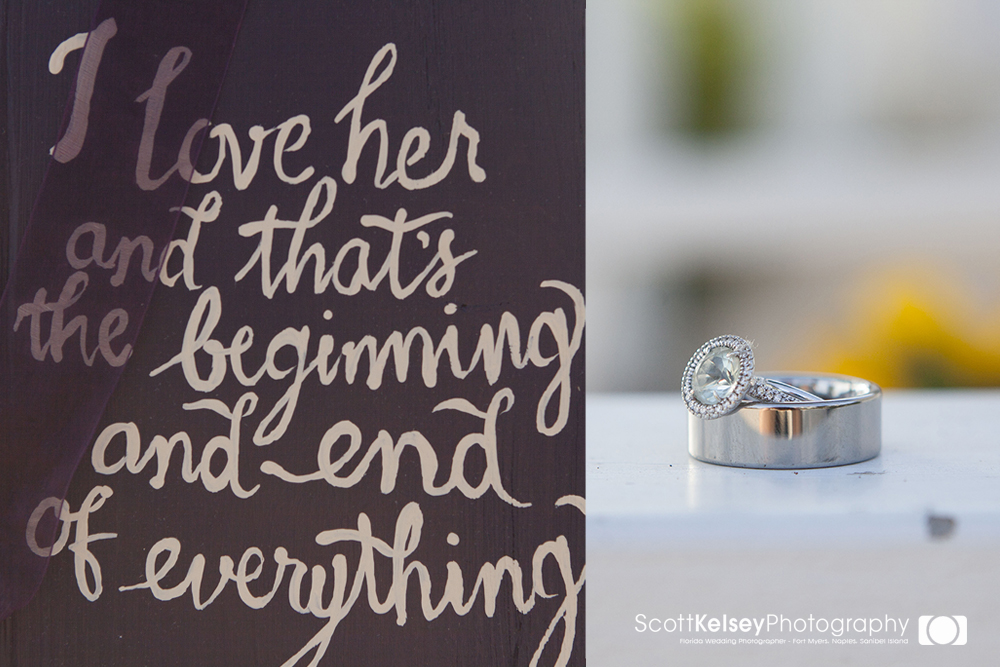

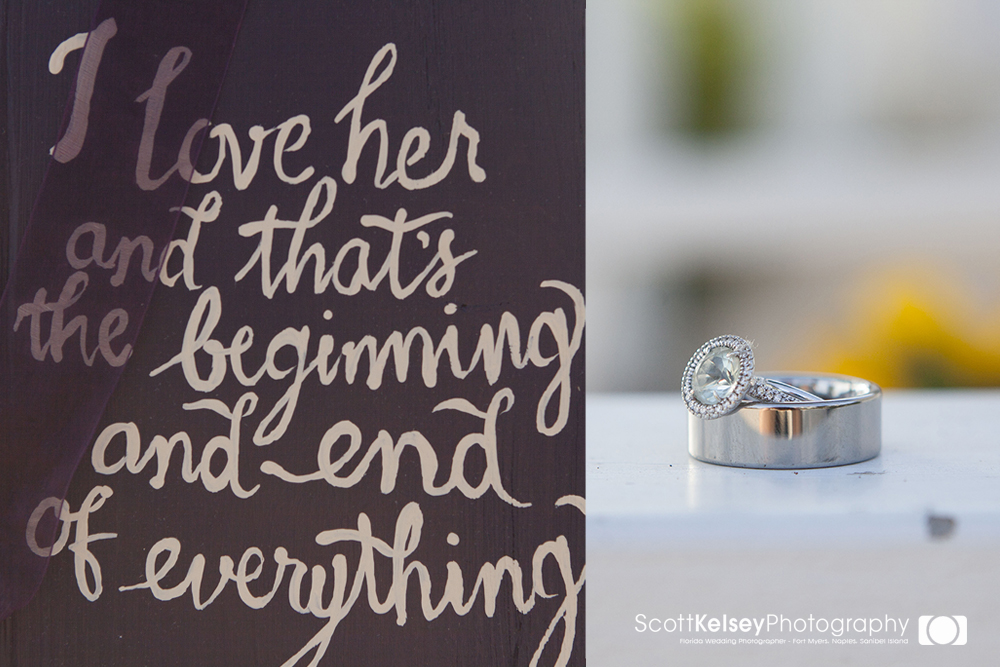

Sunflowers at sunset. Rod and Michaela tie the knot on one of Sanibel’s most beautiful destinations. The newly renovated Island Inn beachfront resort rest on 10 acres and has that old Florida charm. The ceremony setting was decorated with bright yellow sunflowers and purple signs and ribbon. The aisle was lined with hand-painted signs (by the groom) with sweet messages and quotes that made everyone smile.

“I love her and that’s the beginning and end of everything” – F. Scott Fitzgerald

“I married my best friend on July 19 at sunset on the beach of Sanibel Island at the Island Inn, resulting in a modern-day Brady Bunch with each of us bringing two kids to our blended family. Throughout the process of wedding planning, I remained calm, even when my dress didn’t fit 3 weeks before the wedding and through various other small snags. The one and only thing that made my heart pound a little faster was the looming wedding photography. I do not like to be in front of a camera – I have always only felt comfortable BEHIND a camera. My anxiety about the wedding pictures increased throughout the day of the wedding right up to the moment Linsey walked into our cottage. From that point on, she made me feel absolutely comfortable and relaxed, and I even enjoyed our pictures – a testament to Linsey’s skills considering I’ve spent 40 years despising having my picture taken! True to the nature of weddings, the event was a blur but I do recall how seamlessly Linsey fit into the scene, capturing so many wonderful shots of the wedding and friends and family, yet never being present to the point of altering the moment. We were floored by the number of pictures Linsey took and were absolutely thrilled with the quality and beauty of the pictures – even the goofy expressions sported by the 4 kids turned out great! My step-son DOES NOT smile for pictures and Linsey managed to capture some beautiful, candid shots of him – such a rarity and such a gift to us. One of the best pictures Linsey took was especially meaningful. My husband’s parents were unable to travel to the wedding because of his mother’s recent recurrence of breast cancer. A friend used an iPad to Skype with my new in-laws throughout the ceremony so they could still feel included in the event. Linsey got an incredible shot of our friend holding the iPad; with a clear view of my in-laws on the iPad screen with the wedding ceremony taking place is the background. Most photographers would not have picked up on this special circumstance, let alone captured something so poignant. That picture brought grateful tears to our eyes! Every aspect of working with Scott Kelsey Photography went perfectly: the planning, the variety of pictures, the inclusion of all the wedding guests in various pictures, and the thoughtfulness and creativity that went into each shot, creating a wedding portfolio more beautiful and magical than I could have imagined or hoped for. Thank you – we are forever grateful! And we hope to get back to Sanibel Island soon to celebrate my step-father’s 70th birthday. We would love to work with Linsey again for family portraits, and every bride would be lucky to have Scott Kelsey Photography shoot her wedding!”

Posted on July 16, 2014

“My husband and I were recently married in Sanibel Island, FL. Our wedding planner had recommended Scott Kelsey Photography for our wedding day. Since we are not from the area, we didn’t have the opportunity to get to meet the photographer in person, so we had to trust our wedding planner. I also visited Scott Kelsey’s website ahead of time, and immediately, any worries I had were put to rest. I could see that they did beautiful work with their photography!

On our wedding day, both Scott and his wife Linsey were our photographers. Linsey came to work with us ladies first to take pictures, while Scott worked with the guys before the ceremony. I immediately felt relaxed about working with Linsey, and she was very easy-going, fun, and personable. She was full of great ideas for creative poses, and the pictures turned out awesome!

I met Scott during the ceremony and after, and he was fantastic and fun to work with. He kept the photo session open to our requests, and never pushed us to take “common” or “traditional” photos. My bridesmaids even did a fun pose where they jumped in the air! It turned out great! Some of the photos of the flower girl were so amazing, and the petals she was throwing were caught in mid-air in the photo…so beautiful! You can tell by the quality of the photos that Scott is a very skilled photographer. I was also impressed with the variety of photos that he took of the groom and the rest of the guys before the ceremony. It was so fun to see my husband before the ceremony and the expressions on his face…he looked nervous!

Overall, when looking for a local photographer for the Sanibel area and beyond, I would highly recommend Scott Kelsey photography. I loved that they were a husband and wife team, and their styles complimented each other. You can tell they truly love their work. Thank you for such great photography for our special day!”

Rachel and Phil from Minnesota

Posted on June 15, 2014

Had a great time shooting Vanessa and Nathan’s wedding on Sanibel Island. The bride was getting ready at the Mathews beachfront cottage, it’s one of my favorites at the Island Inn with lots of natural light and gorgeous beach views. The groom and groomsmen were at the Sandpiper cottage, another amazing cottage with great views.

The bouquet was fresh cut white Hydrangea’s, so sweet and simple,and looked great with her dress.

The guests received fans to keep themselves cool during the beach ceremony.

Location: Island Inn Sanibel Island Resort

Wedding Coordinator: Glory Williams with A Perfect Beginning

Photography: Scott Kelsey Photography

Posted on June 10, 2014

This wedding took place at the Island Inn Sanibel, Florida. The bride and her family have been visiting the Inn since she was a young girl, it was more than perfect for her wedding. They brought tears to my eyes as I photographed their first dance together at sunset. It WAS beautiful.

Location: Island Inn Sanibel Island Resort

Wedding Coordinator: Glory Williams with A Perfect Beginning

Photography: Scott Kelsey Photography

Posted on May 6, 2014

Jon + Kristine | Naples Beach Wedding

We had the pleasure of shooting Jon and Kristine’s Naples Destination Beach Wedding. We started the shoot off at the Naples Beach Hotel on the lawn and worked our way around the grounds to the beach where the couple said their vows. After the ceremony we walked up and down the beach shooting as many different shots as we could. Congratulations you two and we look forward to shooting more family photos for you all.

Location: Naples Beach Hotel

Location: Naples Beach Hotel

Wedding Officiant – Beach Promises, LLC

Scott Kelsey Photography | 239-834-9744

Posted on March 28, 2014

Sanibel Island Inn Wedding Ceremony

The wedding ceremony was located on the white sandy beach of the Island Inn Resort on Sanibel Island, Fl. The Island Inn is a charming old Florida resort with beachfront cottages, and hotel on the Gulf of Mexico. The beach is covered with gorgeous sea shells and sea oats that are truly beautiful to watch as they dance in the wind.

Posted on January 16, 2014

For our clients we love to present their photos in something special. The luxe DVD Case is one of the DVD designs we love for our seniors/graduates. The unique design with our customized touches makes for a very memorable delivery.

Our senior/graduate portrait packages start at $300 with all images included on DVD. More information here.

Posted on January 5, 2014

What better way to have your senior year portrait photo shoot than to share it with your best friend. This was a fun time with these two beautiful young ladies. We traveled down to Clam Pass Park in North Naples a little before sunset. The sun was golden and the weather was perfect, I couldn’t ask for a more perfect evening. Enjoy!

Naples Senior Portrait Shoot by Scott Kelsey Photography

Posted on December 19, 2013

Loved photographing this mom-to-be at her Pilates studio for her maternity photos. This was a fun and casual way for Nastia to show off her new baby bump and get in a little work out too.

Fort Myers Maternity Photography

Studio: Pilates On The Move at Fitness On The Move in Fort Myers Florida www.fitonmove.com/pilates_on_the_move

Fort Myers Maternity Photography | Scott Kelsey Photography

Posted on October 28, 2013

Wedding at Cottages of Paradise Point on Ft Myers Beach www.cottagesofparadisepoint.com

Makeup Artistry by Michelle www.mwmakeupartistry.com

Hair by Kim Busch of B-Beautiful Salon and Spa www.bbeautifulsalonandspa.com

Scott Kelsey Photography | 239.834.9744

Fort Myers Wedding Photographers Fort Myers Beach Sunset Wedding – Florida Destination Wedding Photographers

Posted on October 24, 2013

We were asked to shoot Ashley’s senior portraits down on Third Street South in Naples.

This is a great area to shoot with all the old Florida cottage homes, huge banyan trees and flowers galore.

After about an hour of shooting 3rd Street and the businesses we made our way down to the Naples, Pier

‘

Posted on October 24, 2013

Alana’s Old Naples Senior Portraits

Looking for the best place to take your Naples Senior Portraits, try Downtown Naples. Alana choose to take her photos in Downtown Old Naples on Third Street. What a fun place to shoot, there is a a ton of cute places to shoot. Colorful old Florida beach cottages, little courtyard gardens throughout Third Street South, beautiful water fountains around every corner and more flowers then you dream of. Book your Old Naples Senior Portraits today. Call today – (239) 834-9744

Downtown Old Naples Senior Portraits | Scott Kelsey Photography

Posted on September 8, 2013

Posted on July 12, 2013

Sanibel Island Wedding

Matt and Andrea just seem like they were made for each other, the way the look into each other’s eyes, the way they smile at one another from 50 feet away… you can just tell. The couple tied the knot on the South side of Sanibel Island, a perfect location because you get to see the sunset over the Gulf.

Scott Kelsey Photography | Sanibel Florida Destination Wedding Photographer

Scott Kelsey | 239.834.9744